As wealth managers lay down markers for where attention will shift this year, Robeco Asset Management has added biodiversity and mining to its list of engagement themes for 2020. The Dutch group’s active ownership team selects new themes each year to strengthen ESG commitments that are now dominating the investment sphere.

Decarbonising investment portfolios and looking at governance in developing regions such as Brazil, South Korea and China are other themes that the sustainable investment firm has said it will tackle this year.

Protecting biodiversity, under water and on land, is expected to loom large for the entire sector in 2020 as the loss of plant and animal species is more closely linked to climate activity, and backed by alarming scientific data of the speed at which this is happening.

“Biodiversity loss is one of the major global ecological threats expected to impact society in the coming decades,” said Carola van Lamoen, head of Robeco’s Active Ownership team. “Investors are exposed to biodiversity loss predominantly through land use change as a result of deforestation through clearing land for expansion of agricultural production.”

Forest stewardship and land use have come under heavy scrutiny in investment circles as fires have raged from the Amazon to wealthy California enclaves; and the wild fires now tearing through communities along Australia’s Eastern coast are nothing short of apocalyptic in scale. Bank of America has forecast that Australia's GDP could be hit by up to 0.4 per cent this quarter, and local estimates suggest that the inferno is costing Sydney A$1.2 billion a day in lost productivity, reduced consumer spending, health issues, and the impact on tourism. That is before the cost to infrastructure is assessed.

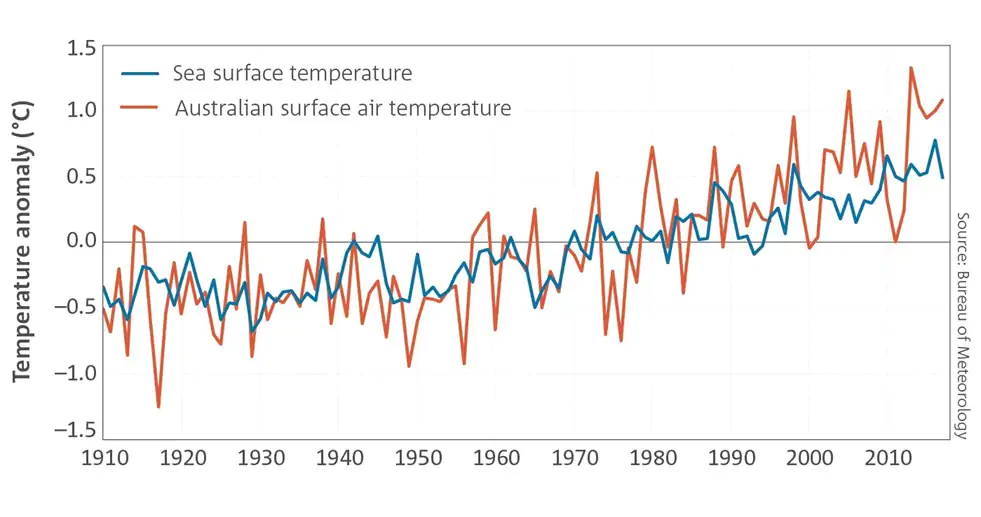

Fitch said on Monday that upgrades to Australian utilities companies have made it less likely that they will suffer the fate of PG&E in California when the utilitiy was forced into bankruptcy under the weight of legal claims on the role its ailing infrastructure played in increasing fire risks. Saxo bank said yesterday that the final impact on the world’s driest inhabited continent "is difficult to gauge at present but will cost the Australian economy billions of dollars. Notwithstanding that a continued increase in frequency of extreme weather related events poses a long term risk for the economy." The Danish bank published this chart showing surface temperature rises over the past century.

The fallout from these extreme events has prompted Mark Carney to reiterate how companies and investors need to be more transparent on the impact - good and bad - of what they are financing. Speaking to BBC Radio 4 recently, the outgoing Bank of England governor said that pension funds analysis has shown that company policies are on course to continue warming trends by “something in the order of 3.7 degrees to 3.8 degrees” Celsius, well outside the 1.5 degree containment set by governments. Carney warned that financial institutions are not reporting in “any consistent way” on how they are managing the transition. “A question for every company, every financial institution, every asset manager, pension fund or insurer: what’s your plan?” he said.

Carney will pick up this theme when he takes up the new role of UN special envoy for climate action and finance. His Task Force on Climate-related Financial Disclosures cofounded four years ago with Michael Bloomberg has seen mixed results in corralling companies to perform and publish impact studies on their exposure to climate risk.

The issue is likely to take on extra urgency this year as more action has been promised by the Securities and Exchange Commission in the US, and in Europe, where measures are underway to enshrine climate risk into investment suitability rules. Accounting firms and insurers are also looking at whether their auditing and underwriting practices are fit for purpose.

With shareholders too demanding more risk disclosures, wealth managers will be keen to lay out more than good intentions this year if they are to convince investors that green finance holds the keys.

Robeco began the year by saying that it will "actively combat biodiversity loss". Providing a taste of what that means practically, the group said: “We want companies that produce soy, cocoa or palm oil, or companies that manufacture food to conduct a biodiversity impact assessment of their operations and/or their supply chains. We also want them to develop plans to achieve zero net deforestation by 2023.”

But being able to measure a company’s impact on biodiversity is not easy. A report last year by AXA Group and the World Wildlife Fund for Nature concluded that impact metrics for biodiversity are much harder to calibrate than for carbon footprints, but said that tools are emerging to “help financial institutions map which sectors are particularly at risk - both on the impact and dependency sides."

The report recommended two schemes in service. The first is the Global Biodiversity Score developed by the Paris-based financial institution CDC Biodiversité . The second is ENCORE, a tool designed for the finance sector by the Natural Capital Finance Alliance to understand exposure to natural capital risk better.

Its developers looked at 167 economic sectors, including the three most prone to economic disruption from natural depletion: agriculture, aquaculture and fisheries, and forest products. The Global Investing Impact Network , which has been keen to grow the impact investing market, estimates that investment in forestry accounts for around 5 per cent of total capital in impact projects.

Source: United Nations Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services , and World Wildlife Fund for Nature

As biodiversity loss moves up the agenda and portfolio companies are assessed on such measures, AXA and WWF made five recommendations to focus the sector:

1. Launch a task force on nature impacts disclosures

2. Integrate biodiversity impact measurement into existing environmental, social and governance rating methodologies

3. Develop a framework for investors to analyze biodiversity risk and engage with companies

4. Create labels for financial products with a positive impact on nature

5. Governments should establish clear priorities towards biodiversity protection